Sakura Research: Calling for Transparency and Accountability at RMG

December 2, 2024

Mail To:

Loh Boon Chye

CEO, SGX Group

2 Shenton Way,

#02-02 SGX Centre 1

Singapore 068804

David Gerald

President & CEO

Securities Investors Association (Singapore)

7 Maxwell Road #05-03

MND Building Annexe B

Singapore 069111

Karen Lee Shu Pei

Audit Partner, KPMG LLP

12 Marina View #15-01

Asia Square Tower 2

Singapore 018961

CC:

Ambassador Dr. Loo Choon Yong, Esq.

Executive Chairman, Raffles Medical Group Ltd

Chairman, Raffles Health Insurance Pte. Ltd.

Majority shareholder (>55%), RMG

Kimmy Goh

Group Financial Controller

Company Secretary

Group CFO (interim)

Lew Yoong Keong Allen (Lead Independent Director)

Tan Wern Yuen (Independent Director)

Audit & Risk Committee, The Board

Raffles Medical Group Ltd

585 North Bridge Road

Raffles Hospital #11-00

Singapore 188770

Introduction

In November, Sakura Research published our 3-part report detailing shortcomings and poor management at Raffles Medical Group (“RMG”, the “Group”), specifically related to the absurdly under-appraised prime Singapore properties ripe for mark-to-market gains, the shocking underperformance of RMG China hospitals compared to IHH Healthcare China, the capital-intensive and loss-making insurance segment, and the unannounced departures of senior executives [1].

We have great admiration and respect for the RMG team and their accomplishments. However, as a minority shareholder, with all due respect, we are dissatisfied with the lack of accountability, non-transparent financial reporting regarding massive investments in Greater China and the insurance segment, and the high turnover in senior management.

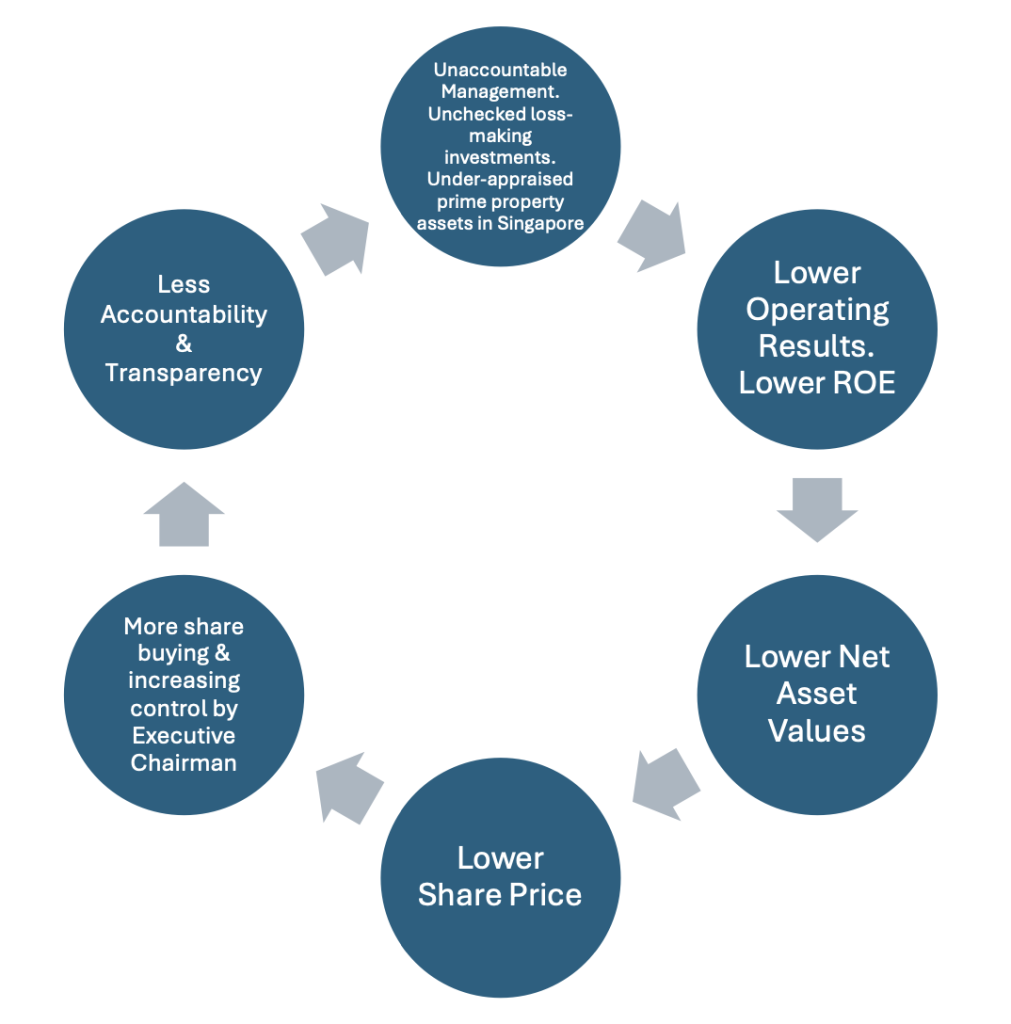

While the RMG senior management team destroys shareholder value and depresses RMG’s share price amid the soaring local stock markets, the Executive Chairman/Founder has increased his control to a record 56%. As a public company, we believe the management is accountable to all shareholders to pursue profitable and sustainable growth, alongside effective succession planning.

Valuation of Prime Singapore Properties: PPE and Investment Properties

The Group owns prime real estate in Singapore, which accounts for the majority of the Group’s net asset value, specifically through its Property, Plant, and Equipment (PPE) properties and Investment Properties (IPs). These Singapore properties make up approximately 60% of the Group’s net asset value, based on our estimates. A correct and market-reflective valuation of these properties is critical for the benefit of all shareholders.

The classification and valuation of Investment Properties have been a key audit matter consistently raised by the Group’s auditors (KPMG). By comparing the Group to its peer hospitals in Singapore (such as IHH Healthcare/Parkway Life REIT hospitals), it is clear to us that both the PPE properties and IPs are absurdly under-appraised by the Group-appointed appraiser. This is largely due to the use of rigid and outdated Level-3 fair value assumptions and estimates.

From 2018 to 2023, the Group’s reported total cumulative fair value gains from Investment Properties were a mere 3.3%, while the generated revenues from these properties increased by a whopping 55% (from S$29.2 million in 2018 to S$45.2 million in 2023). As a result, RMG’s investment properties rental yield % (annual revenue divided by carrying values) has steadily increased, reaching an impressive 18.4% in 2023 compared to 9.4% in 2018. In contrast, the local hospital Parkway Life REIT, has averaged a ~6% annual rental yield during the same period, due to its regular fair value gains on Singapore hospitals.

In 2023, the Group sold one Singapore property from its PPE portfolio for S$518,000, which was a 200% premium over its book value of S$174,000. This further supports our thesis that RMG’s prime Singapore properties are being severely under-appraised.

It is also worth noting that RMG changed its Singapore appraiser in 2021, moving from Jones Lang LaSalle (JLL) to Colliers International.

Accounting statements are meant to reflect economic reality. We call on the Board, local regulators, RMG auditors, and appraisers to independently conduct a market-reflective valuation of the Group’s properties in Singapore, taking into account the empirical evidence of under- appraisal and market prices.

Wrong Investments to Show Growth – Losses in Greater China Segment and in Capital-Intensive, High-Risk Health Insurance

Since 2016, RMG has deployed hundreds of millions of SGD into its Greater China operations, making it the Group’s largest and only major overseas investment. However, its performance has been demonstrably poor.

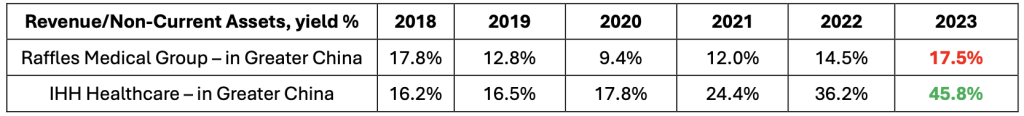

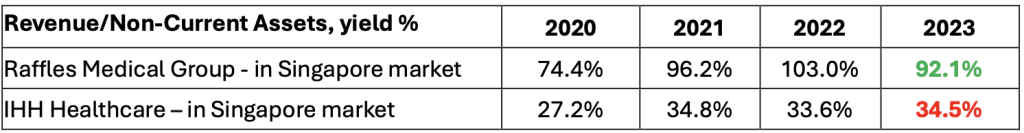

As of the end of 2023, competitor IHH’s Greater China operations became EBITDA-profitable, generating a respectable 46 cents for every dollar invested in non-current assets in China. In contrast, RMG’s revenue yield per dollar of non-current assets is a paltry 17 cents (figure 1).

RMG continues to blame “gestational losses,” the growth phase, and COVID-19 obstacles for its demonstrably poor performance in the Greater China segment.

Moreover, RMG’s accountability regarding the China segment’s balance sheet and the extent of losses incurred in China over the past decade is woefully inadequate. In contrast, IHH Healthcare regularly reports its segment profit/loss statements, as well as balance sheet information, including details on its Greater China segment.

It has been nearly two decades since Raffles Health Insurance (RHI) began operations. However, the transparency of its financial reporting has been woefully inadequate, making it difficult to understand the segment ROEs, balance sheet, and associated risks. With the adoption of new accounting standards in 2023, shareholders finally received a basic breakdown of revenues and P&L for the segment. As a minority shareholder, we request full transparency regarding the Insurance segment’s past performance and future plans for profitable growth.

RMG management team and the Board of Directors can learn a lot from its SGX-listed peer, IHH Healthcare (SGX:Q0F), when it comes to transparent financial reporting, enhancing shareholder value and ROE, and focusing on long-term profitable growth.

Senior Management Team – High Turnover Indicating Unstable Management Amid Key Person Risk & Succession Planning

In recent years, there has been a high turnover of senior executives, many of which were not announced by the Group to stakeholders. These include Ms. Sheila Ng (Group CFO, announced on SGX on November 10, 2024), Ms. Goh Ann Nee (former Deputy CEO of Raffles China Healthcare, not announced), Dr. Vincent Chia (former CEO/MD of Raffles China Healthcare, not announced), and Ms. Juliet Khew (former Deputy GM of Raffles Health Insurance, not announced). While the Group’s 2023 annual report lists 10 executives in senior management, RMG’s website currently lists only 6 executives.

Earnings-Accretive Initiatives to Benefit All Shareholders

* Previously, the classification and valuation of the Group’s Investment Properties were raised as a Key Audit Matter. We request that the Group’s auditors and property appraisers use market prices to value RMG’s prime Singapore properties to benefit all shareholders.

* We call on RMG to initiate a share buyback program to benefit all shareholders, particularly given the under-appraised value of its prime Singapore properties.

* We request a strategic review of the Group to halt the continuous destruction of shareholder value in the Greater China and RHI Insurance segments due to ongoing, misguided investments and unstable team.

As RMG remains a public company, we believe, with all due respect, that RMG management owes accountability to all shareholders. The Executive Chairman (& Controlling Shareholder) should listen to minority shareholders and take actions to improve ROE for all shareholders. Alternatively, offer a fair price to take the Group private and pursue any strategy they desire, regardless of the losses incurred.

Sakura Research

OPINIONS ONLY.

TERMS APPLY.