By viewing material on this website you agree to the following Terms. Use of Sakura Research materials is at your own risk. THIS RESEARCH EXPRESSES SOLELY OUR OPINIONS.

Having accepted our terms and conditions, feel free to view and read our full research here.

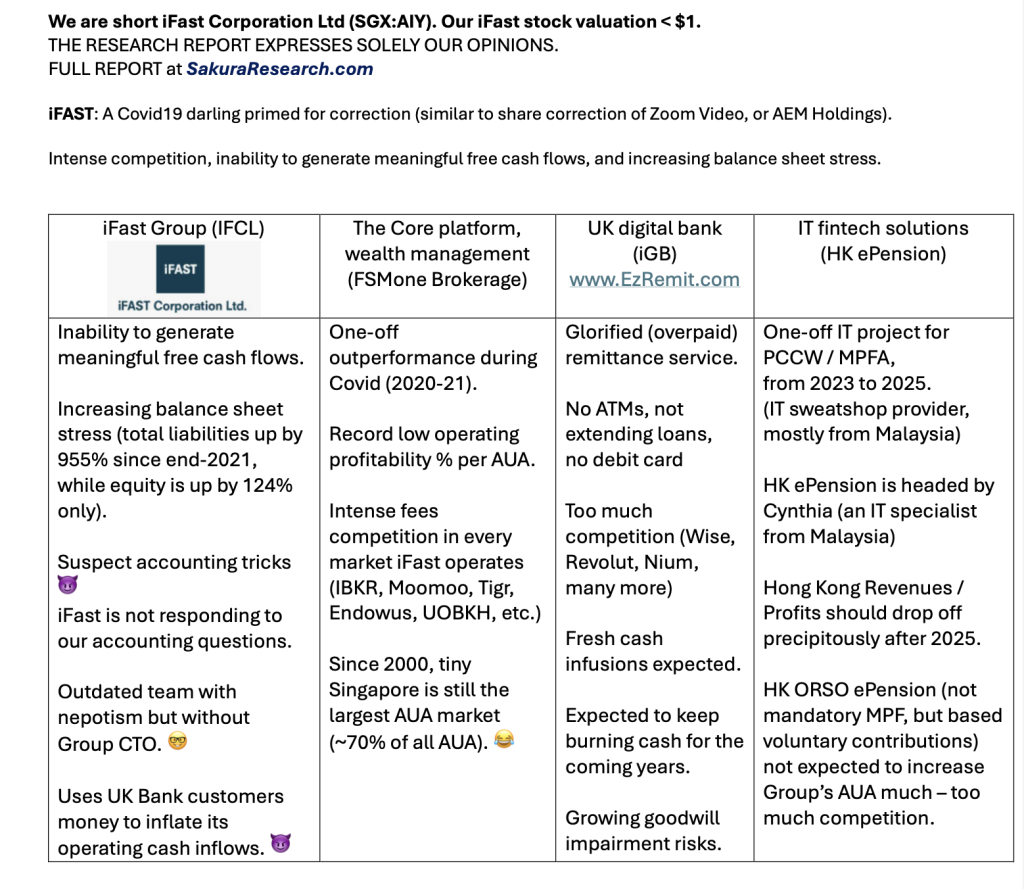

We are short iFast Corporation Ltd [SGX:AIY].

Accounting Questions for iFAST Corporation Ltd (SGX:AIY)

The questions were communicated through email to: iFast Management, iFast Lead Independent Director, iFast Auditor (KPMG), SGX RegCo, and Singapore SIAS.

a) Since early 2022, IFAST is estimated to have spent around £94 million GBP (a whopping S$160 million, 84m GBP in equity and 10m GBP in loans) to fully acquire a former remittance business-based BFC bank with net tangible assets value of just £13 million GBP before the acquisition.

Following IFAST’s complete 100% acquisition of Eagle Peak Holdings Ltd (also known as EPHL or IFAST UK Holdings Ltd) on September 12, 2024, could you please clarify and provide the latest information on the following:

Net asset value and Tangible net asset value of IFAST UK Holdings Ltd (EPHL)

Net asset value and Tangible net asset value of iGB

b) The former CEO of BFC Bank, Mr. Mujahid Malik, is still the CEO of iGB Digital Bank. He appears to be an accountant by training and is currently working for an additional five UK companies besides IFAST Global Bank: CoveFine Property Management Ltd, MRM Investments Ltd, 33 Abercorn Place Ltd, 31 Abercorn Place Freehold Ltd, and Apsley Grange Ltd.

How does IFAST Bank plan to generate profitable growth in a high-tech and highly competitive environment with an outdated and unfocused management?

c) In its 2023 annual report submitted to SGX, iFast reported a total pre-tax loss for the UK bank of approximately £8 million (a sum of S$8.6 million in losses for 2022 and S$5 million in losses in 2023).

However, iFast Global Bank in the UK recorded a total loss of £17.57 million GBP for both 2022 and 2023.

Did iFast Corp understate and underreport its UK banking operations loss by around £9-10 million GBP over these two years?

d) Banks classify customer deposit flows under financing cash flows, as they are considered “liabilities” and a form of funding for the bank. However, IFAST includes its UK bank’s (iGB) customer deposit flows as part of its operating cash inflows. This approach may give public investors a misleading impression of IFAST’s impressive operating cash flow generation capacity since acquiring the UK bank in 2022. In reality, their adjusted operating cash flows (by excluding UK bank customer deposit flows) have suffered significantly since the profit and cash flow boost experienced during COVID19.

Why is IFAST Corp not accounting for iGB UK bank customer deposit flows under financing cash flow?

e) The impairment of goodwill related to the UK bank acquisition is one of the Key Audit Matters (KAM) raised by the Group auditors (KPMG). As the UK bank derives most of its profits from EzRemit overseas transfer fees and commissions, it operates in a highly competitive environment dominated by traditional players as well as fintech giants, including Revolut, YouTrip, Nium, Wise, PayPal, and others.

iGB Bank’s net fees and commission income have dropped from £3.656 million in 2022 to £3.557 million in 2023.

After years of losses, does IFAST plan to recognize any further goodwill impairment related to the 100% acquisition of iGB? If so, how much and why?

f) IFAST Management has reported that its UK Bank (iGB) looks set to become a key growth driver from 2025 onwards. Digital banks have often struggled with profitability, requiring frequent and substantial capital infusions even with world- class technology teams. For example, Sea-owned MariBank experienced widened losses in 2023, while GXS Bank (founded in 2022 and backed by Singtel and Grab Holdings) aims for profitability by 2027.

According to the 2023 annual report filed by IFAST Global Bank Limited in the UK, the bank did not recognize any deferred tax assets, as iGB does not reasonably anticipate profitability for iGB Bank over the next 3 to 5 years.

While iFast Corp advised that it targets iGB to break even and achieve a profitable quarter in Q4 2024, how do you plan to operate profitably in 2025, 2026, and beyond, especially without extending traditional consumer and/or business loans?

What is iGB’s current net interest margin (NIM) for its banking operations? We estimate it to be less than 0.5%.

When do you expect the bank’s return on invested capital to exceed the rate of 4.3% on your inaugural $100 million bond?

g) IFAST aims to grow its wealth management & brokerage’s Assets Under Administration (AUA) to $100B by 2030. AUA reporting by iFast has been mentioned as a Key Audit Matter by iFast auditors (KPMG).

When and why did IFAST decide to include UK bank customer deposits in the Core Wealth platform’s AUA figure?

Is this legal? How will this decision affect the operating profitability % margin per AUA?

Customer deposits, by nature, can be withdrawn from the UK bank at a moment’s notice. What makes IFAST believe that UK bank customer deposits should be treated as AUA to generate recurring revenues?

Source: iFAST Corp 2Q2024 & 1H2024 Results Briefing on YouTube (12:19 / 1:00:24)

https://www.youtube.com/embed/aivg1PTSprU?si=8zi-HBmQgGZjZiaB

h) Since the founding of IFAST, Singapore has been and remains the largest country, accounting for approximately 70% of IFAST’s AUA. However, Hong Kong, with approximately 12% of IFAST’s AUA, surpassed Singapore in earnings and revenue contribution to IFAST for H1 2024.

iFast Corp reported: “The ePension division in Hong Kong will be an important growth driver for IFAST in 2024 and 2025. The company also expects the UK Bank to become an important growth driver in 2025 and beyond.”

The Hong Kong profit guidance for profit before tax in 2025 was HKD 500 million.

Can iFast provide any estimates or ranges for revenues and/or profit before tax for the Hong Kong market for 2026?

i) iFast auditors (KPMG) have previously flagged revenue recognition policies as a Key Audit Matter (KAM), relating to both the platform AUA accrued revenues and IT solution accrued revenues. Accordingly, the calculation of accrued revenues related to both IT solutions and in-house AUA reports involves judgment and is an area of potential fraud risk. Revenues for any given year include accrued revenue for services that have been rendered but for which customers have not yet been billed (invoiced).

What is the dollar value of Unbilled Uncompleted Contract Receivables for 2023, Q1 2024, and Q2 2024?

What is the dollar value of Unbilled Trade and Other Receivables for 2023, Q1 2024, and Q2 2024?

j) Grand total receivables (including both Trade receivables & Uncompleted Contract Receivables) have grown to $194m on 31-Dec-2023 (a whopping 78% increase YoY). In the same vein, just the Trade receivables have grown 48% to 201,695,000 in Q2, 2024 vs. $136m on on 31-Dec-2023.

Despite these rapidly worsening trends, iFast recorded nearly 0% credit impairment annually, from 2020 to 2023.

What are the distributions as per below counterparties for the Trade Receivables?

Group Distributors: %

Retail customers: %

Amounts due from related parties & associate company: %

Others: %

Similarly, what are the % distributions as per above counterparties for Uncompleted Contract Receivables?

k) We note that as of 31 July 2024, “trade and other receivables” amounted to $201 million, a significant ≈48% increase from the earlier 6 months (31 Dec 2023), where iFast recorded “trade and other receivables” of $136 million.

(1) Please provide a breakdown of these “trade and other receivables.”

(2) Please provide the aging schedule of these “trade and other receivables” totalling $201 million, broken down into bands of 3 months.

(3) Elaborate on the credit terms and policies for these trade and other receivables, as well as any trends in credit impairment.

l) Equity-settled operating expenses (for both staff compensation and external advisor payments) have increased more than 3 times in just 3 years, from S$3.27m in 2020 to S$12m in 2023. This certainly helps conserve cash for IFAST and flatter its operating cash flows.

Who and which company control these shares and equity options for Group’s staff & external advisors during the vesting period? Is it Crouzet Limited or Caerulean Limited, both incorporated in the British Virgin Islands?

What’s the average vesting period and other key issuance policies?

Who is auditing and controlling against misuse and misreporting of these shares?

m) In our opinion, iFast’s cash flow issues seem evident in the rising trade payables. Our calculated Days Payable Outstanding (DPO) has been increasing steadily to record highs, nearly doubling from 2021 to 2023. If the Group’s financials are accurate, it now takes around 8 months on average to pay its suppliers.

DPO days: 2023: 254 days, 2022: 208 days, 2021: 134 days

Who are the top 10 suppliers of iFast?

How are suppliers reacting to the delayed payment terms, and what impact is this having on supplier relationships, terms of trade, and iFast’s operating profitability?

n) IFAST operations are becoming more complex both geographically and operationally as it aims to become “Truly Global.” IFAST uses many specialized in-house terms, such as net revenues, recurring revenues, B2B revenues versus B2C revenues; banking and non-banking profit before tax; AUA, and others.

In addition to these specialized terms and in-house assumptions & calculations, investors and stakeholders need to understand the cash flows relative to the invested capital.

For clarity, could IFAST provide the following information for the latest periods (FY 2023, Q1 2024, and Q2 2024):

IFAST Corporation’s Free Cash Flow to Equity (FCFE) after excluding the UK Bank Customer Deposits inflows

IFAST Corporation’s Free Cash Flow to the Firm (FCFF) after excluding the UK Bank Customer Deposits inflows

By viewing material on this website you agree to the following Terms.

Use of Sakura Research materials is at your own risk.

THE RESEARCH EXPRESSES SOLELY OUR OPINIONS.

Opinions only.

SakuraResearch.com

medium.com/@SakuraResearch

info {at} SakuraResearch {dot} com