By viewing and/or using material on this website you agree to the following Terms. Use of Sakura Research materials is at your own risk. THIS RESEARCH EXPRESSES SOLELY OUR OPINIONS.

We are long UOB-Kay Hian (SGX:U10).

The Full report can be found here.

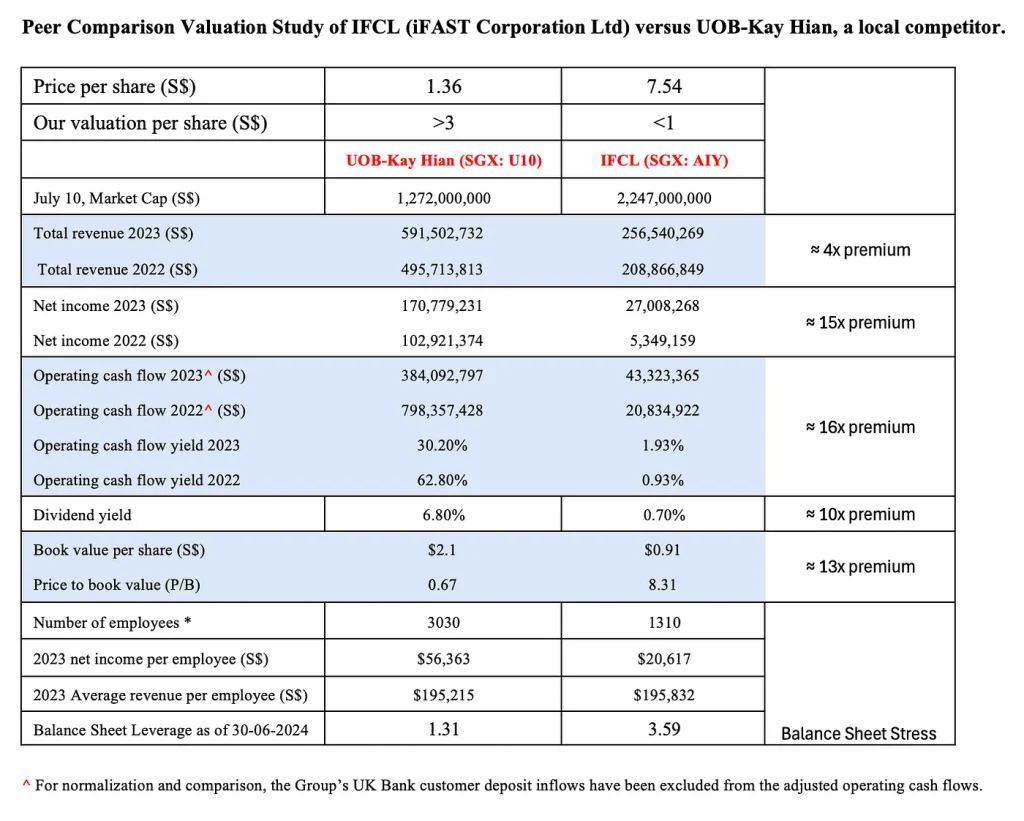

UOB Kay Hian Holdings is a Singapore-based brokerage firm with a market capitalization of approximately S$1.3 billion, and it engages in brokerage services, private wealth management, investment management, and financial research. Based on our in-house calculations, UOB-Kay Hian (UOBKH) trades at significantly lower valuations in every aspect (such as book value, operating cash flow multiple, P/S and P/E multiples, net income per worker, and dividend yield), suggesting to us more than 90% average downside for iFast Corporation Ltd shares.

We see an average valuation premium of about 12 times for the Group compared to UOBKH’s valuation. The Group’s valuation premium ranges from about 4 times to about 16 times compared to UOBKH’s valuation.

In our humble opinion, UOBKH, which boasts a dividend yield-rich and cash flow-rich profile along with a cash-rich balance sheet, is grossly undervalued. Given the limited free float (approximately 25%) and the market valuation significantly below book value, we believe it is a prime candidate for a privatization/takeover deal by UOB (similar to the recent takeover of Great Eastern Holdings by OCBC).

Recently, UOBKH has been increasing its stake in Bangkok-Listed UOB Kay Hian Securities (Thailand), which trades attractively at ~0.6 P/B only.

Additionally, UOBKH provides custodial services to the fast-growing Endowus, allowing UOBKH to gain more customers through Endowus.

For all these reasons, we think that UOBKH shares are massively undervalued and should be trading at more than S$3.

Having accepted our terms and conditions, feel free to view and read our full research here.

Opinions only.

SakuraResearch.com

medium.com/@SakuraResearch

info {at} SakuraResearch {dot} com