By viewing material on this website you agree to the following Terms. Use of Sakura Research materials is at your own risk. THIS RESEARCH EXPRESSES SOLELY OUR OPINIONS.

Having accepted our terms and conditions, feel free to view and read our full research here.

We are short iFast Corporation Ltd (SGX:AIY).

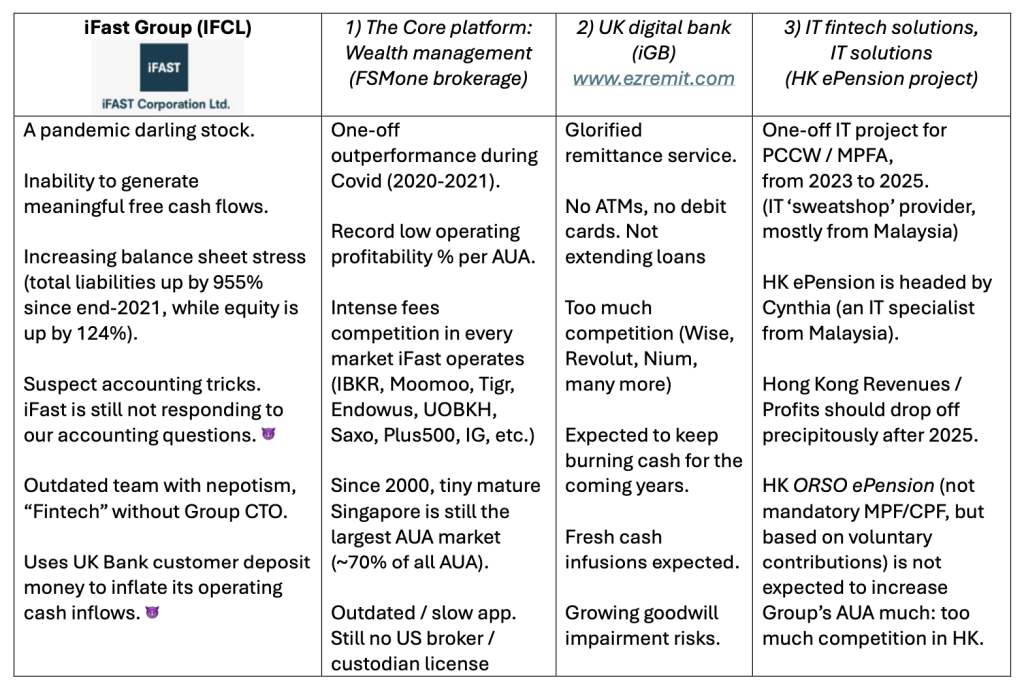

After months of analysis, we believe that iFast operations and performance are fundamentally misunderstood by the public, that it cannot generate meaningful free cash flows, iFast balance sheet shows increasing stress, and that iFast share fair value is a fraction of its current valuation.

The “Blue-Chip” research teams such as DBS Research and CGS International have price target of approximately S$9.50 per share.

Our research valuation per share is <S$1.

Analysts include:

Ms Ling Lee Keng, DBS Research Platform, DBS Group Research analyst

Ms Andrea Choong, CGS International (CGSI) analyst

Messrs Aakash Rawat and Benjamin Tan, UBS Global Research analysts

Messrs Heidi Mo and John Cheong, UOB Kay Hian Private Limited analysts

Mr Tan Yong Hong, Citi Research analyst

Blue-Chip Research House Misconceptions about iFast Corp (SGX:AIY)

m1

Hong Kong ePension is a long-term recurring revenue source, to continue after 2025.

Nope. “From Q2 2024 RESULTS ANNOUNCEMENTS: The Group Management believes that the ePension division in Hong Kong will be an important growth driver in 2024 and 2025.”

What will happen to Hong Kong’s revenue or profit guidance in 2026 when the HK ePension project enters the Maintenance phase?

We estimate a 70%-80% drop once this IT project enters the maintenance phase from the 2023-2025 implementation phase.

We think ePension IT fintech solutions project revenues are mostly non-recurring.

m2.

Hong Kong ePension will increase iFast total AUA and create recurring revenues.

Nope.

The so-called ORSO ePension is based on voluntary contributions (not mandatory HK MPF/CPF contributions) and it is expected to be a tiny AUA-bringing project to iFast, with no meaningful contribution to iFast core fintech platform’s AUA.

This is due to massive competition in pension services trustee & administration fees in HK, real estate meltdown in China/HK, and the weak equity markets in China/HK. No wonder iFast still can’t meaningfully diversify its AUA from tiny & mature Singapore market since iFast founding in 2000. Singapore market still accounts for the whopping ~70% of all iFast AUA. We think because their technology and services are not competitive (vs. so many numerous competitors).

The sad thing is that iFast FSMone platform is not licensed as a custodian for the US equity markets yet (the most important stock markets in the world!).

m3.

The Assets Under Administration (AUA) is showing great growth.

Nope. Since the Group’s founding in 2000, its AUA hasn’t diversified away from its small and mature market (Singapore ~70% of all its AUA), facing intense competition from Endowus, Moomoo, IBKR, Tiger, Syfe, StashAway, and numerous others in every market the Group operates.

The Group seems so desperate that it now probably counts the UK Bank (iGB) customer deposits towards its AUA number, to artificially inflate the Brokerage/wealth management platform’s AUA numbers?!

m4.

We think AUA has reached critical mass, spurring better operating margins.

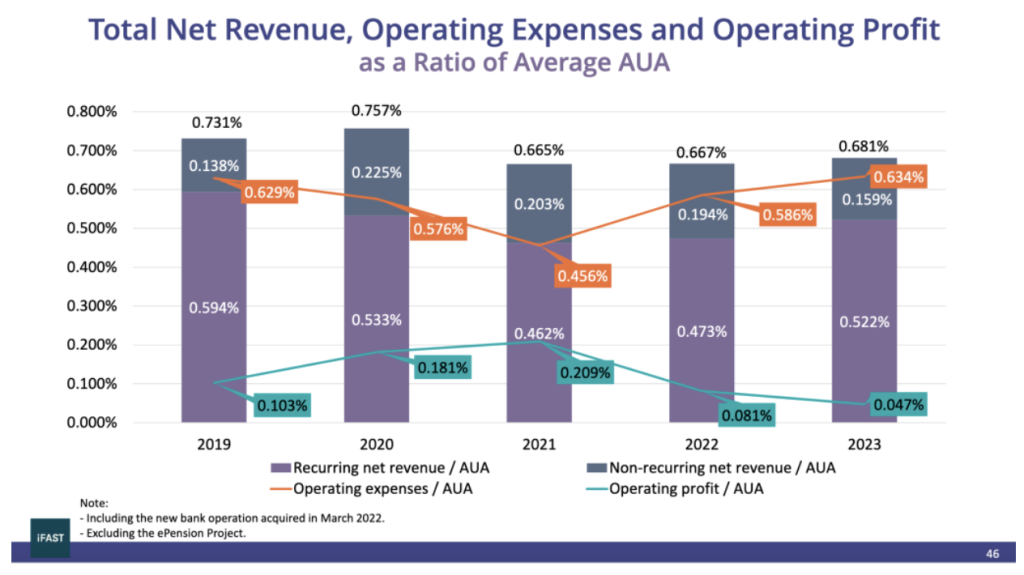

Nope. Actually the Group’s operating profit margins per AUA are dropping to record lows after the 2020 and 2021 one-off Covid outperformance.

m5.

UK Global Bank customer deposits rose to $646m in 2QFY2024 from $359m at the end of 2023.

The UK Bank is going to be profitable soon, right?

Nope. Upstart digital banks are famously cash-burning for many years, before they can become sustainably profitable. We estimate significant losses and cash burning in 2025 and after, before iFast iGB bank can generate meaningful net profits in the UK bank. Watch out for the goodwill impairment risks related to the UK bank acquisition.

The sad thing is that this so-called bank is not extending a normal business or customer loans to create meaningful profits and ROE.

m6.

Net interest margin is the main operating profit source, correct?

Nope. For 2023, net fee and commission income (EzRemit) of £3,557,000 was more than double the net interest income of £1,701,000 GBP. How does the Group plan to compete with remittance fintech giants such as Revolut, Wise, Nium, and numerous others? This might necessitate further goodwill impairment charges.

Essentially, the so-called iFast GLOBAL BANK is a glorified remittance service, competing with WISE, REVOLUT, traditional players, Nium, and many many many more.

m7.

iFast Group is growing its revenues, net income and generates amazing cash flows, right?

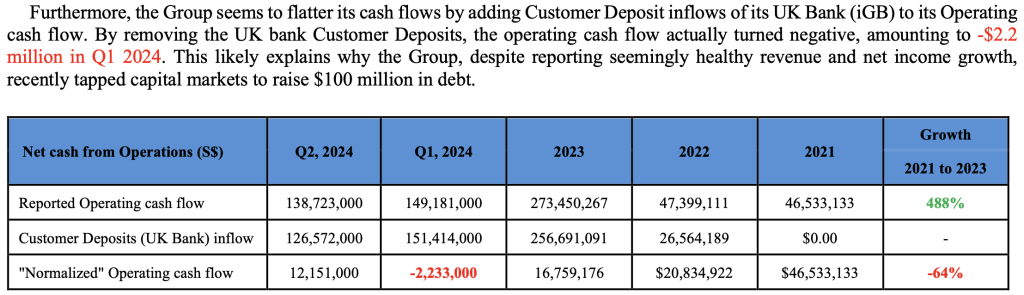

Nope, since the COVID 2020 and 2021 peaks, the Group cash flows are struggling. Miserable cash flow yields, we think. Free cash flows does not seem to be enough to even cover the annual Capital Expenditure (CapEx) and dividend payments.

No wonder iFast had to issue $100m bond at ~4.3% recently.

m8

SGX-listed iFast is a great dividend-paying stock, and its dividends are set to increase further.

Nope, a ~0.7% dividend yield is so meagre compared to the risk-free Singapore savings bond yields or its local peer’s (UOB-Kay Hian Holdings Ltd) dividend yield of 6%+.

The Group’s operating cash flows, after deducting the UK bank Customer Deposit inflows, can barely cover the Group’s annual CapEx and dividend payments. The current free cash flow yield is less than 1%.

No wonder the Group had to borrow $100m at 4.3% rate recently because its cash flows have been suffering since the 2020 and 2021 Covid peaks.

THIS RESEARCH EXPRESSES SOLELY OUR OPINIONS.

Use of Sakura Research materials is at your own risk.

SakuraResearch.com

medium.com/@SakuraResearch

info [at] SakuraResearch{.}com